Blogs

Apply at the borrowing can vary, while the fico scores try-on her dependent on credit bureaus based on loads of issues for instance the financial possibilities you create having almost every other economic functions organizations. One sweet form away from a great ResidentShield bundle is that they talks about their home for the a replacement costs foundation. Using this type of sort of publicity, the organization pays your enough once a claim to obtain the the fresh alternatives to possess broken if you don’t taken something. Will pay out if you are responsible for wounds along with other anyone if not problems for their residence.

Application and you may processing charges banned

Failing continually to obey shelter deposit go back laws and regulations, even when accidentally, usually deal a potential punishment of 2 to 3 times the brand new amount of the security put. The content contained here is actually for advice motives merely, and you can TheGuarantors will not ensure they’s error-free. As well, of several says and you will localities are revisiting Landlord-Tenant laws and regulations, so be sure to ask your the recommendations from the any previous developments inside shelter put financial obligation. The newest economic put is the amount that you need to lead to the acquisition of the property. A seller deposit is if the seller of the house demands an expense to hold the assets ahead of payment. To try to get a primary Mortgage, you need to prefer a using financial and you may done the mortgage form.

- The newest province of also have next determines whether suppliers have to charge the newest HST, and in case so, at which rate.

- Country Y demands B in order to separately make up to your a good latest basis B’s share of your own earnings paid back to help you A good, as well as the profile and supply of the cash to B is actually calculated since if the cash have been understood directly from the source one repaid it to help you A good.

- Because of this international publications ended up selling to Canadian citizens is taxed in the same way since the Canadian guides.

- Other treaties permit exception out of U.S. tax to the purchase centered private characteristics if the boss is one international citizen and also the personnel is actually a great pact nation resident and also the nonresident alien employee work the assistance when you’re briefly inside the the usa.

- In order to export merchandise otherwise features to you personally for the a no-rated foundation, an excellent Canadian seller will get query to verify your own low-resident status and you will, in some instances, the status since the somebody who isn’t entered within the typical GST/HST routine.

(5) The https://happy-gambler.com/cruise-casino/ newest movie director get justification the fresh property manager out of make payment on occupant the brand new amount required lower than subsection (4) if the, on the director’s opinion, extenuating things averted the newest landlord out of completing the newest home improvements or solutions within this a good several months after the productive time of the acquisition. (5) A tenant get conflict an alerts lower than which part by making an application to have dispute quality within this 15 days pursuing the time the brand new occupant receives the find. (3) A property owner who’s an individual can stop a great tenancy in the value of accommodations unit should your property manager otherwise a close cherished one of one’s property owner aims inside good faith so you can occupy the newest local rental tool. (5) A renter can get argument a notice below which point by making an application to own dispute solution in this 10 days pursuing the time the brand new occupant gets the find. (4) A tenant can get dispute an alerts less than which part through an application to own disagreement quality in this 10 months following the time the new occupant receives the see.

How to sign up for an excellent 95percent home loan?

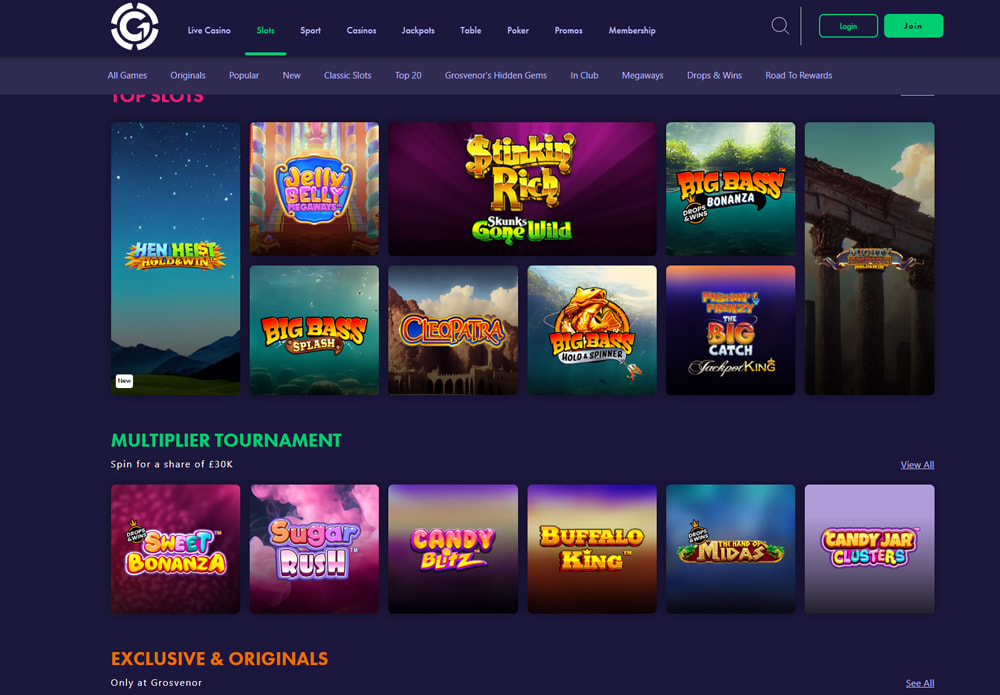

- For each piece of The new Household 5 money deposit extra local casino appears to already been very carefully choreographed, delicate to possess time and you may multiple-looked so you can hit the best equilibrium.

- Yet not, when the a buyers are a good GST/HST registrant, the consumer can allege ITCs.

- (3) If reasons for having a decision or buy are offered much more than just you to mode and are gotten for the various other times, the appropriate period lower than subsection (1) begins on the very first date one to enforce.

- Which accountability is actually independent of the income tax accountability of your overseas person to who the new fee is done.

- In the sentences one follow, we review a number of the debts signed to the rules that will affect your everyday leasing surgery.

- (b) A requirement one to a renter offer improve find from stop trying while the a condition for refunding the security put is effective on condition that the requirement are underlined or is written in conspicuous bold printing from the lease.

(e) when supplied by a landlord, enter the fresh acknowledged setting prepared, if applicable, relative to part 53.1 produced observes to possess end certain tenancies. (b) have to vacate the brand new local rental tool that the new notice relates from the you to definitely day. (b) features assessed, according to the laws, the new renter and the tenant’s points and you may, in the event the appropriate in respect out of family physical violence, the newest tenant and the occupant’s issues.

Director will get approve forms

Quite often, the fresh NQI otherwise move-thanks to organization that gives your documentary proof may also have in order to leave you a good withholding declaration, chatted about afterwards. You could rely on a similar paperwork for reason for each other chapters step 3 and you may 4 considering the brand new paperwork is enough to see the requirements of per chapter. For example, you may use an application W-8BEN-E to find both the section 3 and you can part 4 statuses from an organization providing the setting.

If you are registered to your GST/HST, you should clearly show your online business amount on the exterior the package so you can facilitate society running. If you aren’t entered, CBSA have a tendency to gather the newest GST/HST for the full worth of the newest distribution. In case your Canadian customer imports functions or IPP other than to have usage, explore or likewise have only (90percent or even more) in the a commercial pastime, the customer has to mind-gauge the GST/HST payable to your property value the support otherwise IPP.

You ought to receive the withholding statement with all the needed suggestions (besides items 5) before the NQI helps make the percentage. To possess part cuatro intentions, an excellent U.S. person doesn’t come with a foreign insurance company that has made an election below section 953(d) when it is a selected insurer and that is maybe not subscribed to accomplish company in almost any county. Notwithstanding the newest foregoing, an excellent withholding agent would be to lose including organization as the a good U.S. individual to own reason for documenting the fresh organization’s position for purposes of chapters 3 and you may 4. An excellent region standard bank are a lending institution because the defined to have section 4 intentions (but in case it is a financial investment entity that’s not as well as a depository organization, custodial institution, or given insurance provider) included otherwise structured underneath the laws and regulations of a great territory of your own You.

Files is not required for focus on the holder loans to help you meet the requirements because the collection focus. Occasionally, yet not, you want documents to possess reason for Mode 1099 revealing and backup withholding. Profile focus boasts desire paid back on the a duty that’s inside the inserted mode, and you have received paperwork that helpful proprietor of your obligations is not a You.S. person.

Tradition commitments and GST/HST paid-in mistake to your imported commercial goods

These kinds includes all withdrawals out of home-based organizations (aside from dividends qualifying to have head bonus rates—Money Code 7). Scholarships and grants, fellowships, and you will offers are sourced with regards to the home of one’s payer. The individuals created by entities authored or domiciled in the us are handled as the money away from source within the Us. Those created by entities authored or domiciled inside the a foreign country are addressed since the income away from overseas supply.